In addition, companies were continuously investing in infrastructure and equipment to keep up with user growth and deliver the best user experience. Here, profitability was not as important over the last few years, as the main goal for each company in the industry was to grab market share by offering products at low prices. The core market for Dropbox by revenue is the cloud storage market. The sectors in which Dropbox operates (cloud storage, content collaboration, and e-signing of documents) are all expected to grow in the coming years.

Industry overviewĭropbox operates in a growing and cash flow-positive industry, fueled by long-term tailwinds such as the trends of increasing distributed work and a growing share of freelance workers.

This has panned out well so far and is reflected in the company's financials (e.g., revenue growth and paying users growth). The company is planning on growing paying users both organically and through acquisitions of companies that fit well in Dropbox's environment of products and services.

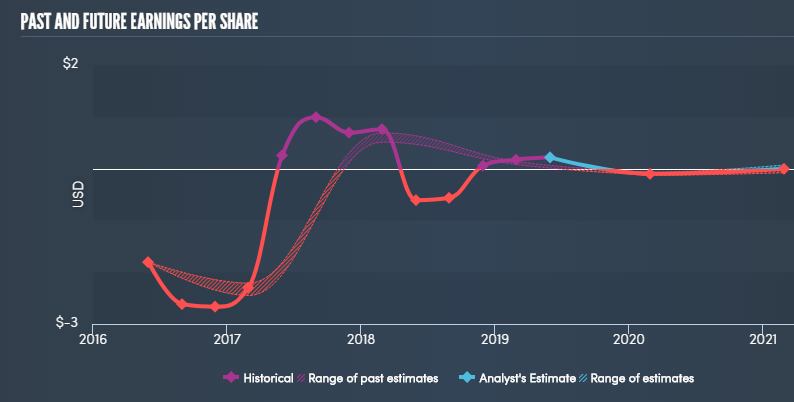

The company just recently acquired HelloSign (an e-signature and document workflow platform), DocSend (a platform for secure document sharing and advanced analytics), and Command E (a universal search engine). Over the last few years specifically, the company has evolved from offering pure cloud storage solutions to offering a place where individuals and teams can collaborate, keep files in sync, and organize their work. Today it offers solutions at different price points for individuals, families and teams. The company started out as one of the first cloud storage providers for individuals in 2007. Assuming a 15% rate of return on investment, I arrive at a fair value of $25-$26 for the stock (more on that consideration in the valuation section). Click here to find out more »ĭropbox ( NASDAQ: DBX) is a company that managed to develop and grow a business model with recurring revenue, producing strong free cash flows and turning profitable for the first time in 2021. Active contributors also get free access to SA Premium. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Editor's note: Seeking Alpha is proud to welcome Samuel Pezzetta as a new contributor.

0 kommentar(er)

0 kommentar(er)